Fort Collins Estate Planning Lawyer

At W.B. Moore Law, we understand that estate planning is a crucial aspect of life planning that ensures your assets and loved ones are protected and cared for according to your wishes. Located in the heart of Fort Collins, CO, our team specializes in providing personalized and comprehensive estate planning services tailored to meet the unique needs of each client. From drafting wills and trusts to navigating complex legal and tax implications, we leverage our expertise to secure your legacy and provide peace of mind for you and your family.

Table Of Contents

- Make Necessary Updates To Your Estate Plan

- Creating A Revocable Living Trust

- What Is The First Thing I Will Need To Do

- What If I Forget To Put Something In My Trust

- How Arbitration, Mediation, And Collaborative Divorce Different

- Why Trusts And Wills Are Not The Same

- Estate Planning Infographic

- Estate Planning FAQs

- How W.B. Moore Law Can Help

As estate planning lawyers in Fort Collins, CO, we at W.B. Moore Law are committed to delivering exceptional legal guidance and support throughout the entire estate planning process. We recognize the importance of understanding our clients’ goals and concerns, and we work diligently to ensure that their estate plan reflects their desires and provides for their loved ones. Whether you’re looking to establish a new estate plan or update an existing one, our team is here to guide you every step of the way, ensuring that your estate is managed and distributed according to your wishes.

Make Necessary Updates to Your Estate Plan

Estate planning is not a one-time task but a continuous process that should evolve with your life’s changes. At W.B. Moore Law, we emphasize the significance of revisiting and updating your estate plan to reflect your current circumstances and future objectives. Whether due to changes in family dynamics, financial situations, or laws, ensuring your estate plan remains aligned with your wishes is crucial. An outdated estate plan can lead to confusion, familial disputes, and unintended consequences, undermining the very protection and peace it was meant to provide.

Life Events That Necessitate an Estate Plan Review

Several life events should prompt you to update your estate plan. Major life changes such as marriage, divorce, the birth of a child or grandchild, the death of a beneficiary, significant changes in financial status, or moving to a new state all warrant a review of your estate documents. Additionally, changes in your preferences regarding executors, trustees, or guardians for minor children should be reflected in your estate plan. At W.B. Moore Law, we guide our clients in Fort Collins, CO, through the process of revising their estate plans to ensure that these documents accurately represent their current wishes and circumstances.

Legal and Tax Implications

Changes in federal and state laws can also impact your estate plan. Tax laws, in particular, are subject to frequent adjustments, and what was a tax-efficient strategy a few years ago may no longer be beneficial today. Working with an experienced estate planning lawyer in Fort Collins, CO, can help you navigate these complexities, ensuring your estate plan takes advantage of current laws and regulations. At W.B. Moore Law, we stay abreast of legal developments to provide our clients with informed advice on optimizing their estate plans for tax purposes and legal protection.

Making the Update Process Smooth

To make the estate plan update process as smooth as possible, we recommend gathering all relevant documents, including your current will, trusts, powers of attorney, healthcare directives, and a list of your assets and debts. This preparation allows us to efficiently assess your existing estate plan and make necessary adjustments. We encourage our clients to think about their goals, values, and the legacy they wish to leave behind, facilitating a more meaningful and personalized estate planning experience.

At W.B. Moore Law, we understand the importance of keeping your estate plan current. We invite you to contact us for a comprehensive review of your estate plan. Our experienced team of estate planning lawyers in Fort Collins, CO, is dedicated to providing you with the guidance and support needed to ensure your estate plan accurately reflects your wishes and provides for your loved ones. Let us help you secure your legacy and achieve peace of mind by ensuring your estate plan is up-to-date.

Creating a Revocable Living Trust

Creating a revocable living trust is a critical component of comprehensive estate planning. At W.B. Moore Law, we understand the value of this estate planning tool in managing and protecting your assets both during your lifetime and after. A revocable living trust, managed by an estate planning lawyer in Fort Collins, CO, offers flexibility, privacy, and ease of transfer of assets to your beneficiaries, avoiding the often lengthy and public process of probate.

What is a Revocable Living Trust

A revocable living trust is a legal document that you create during your lifetime. As the grantor, you can transfer ownership of your assets to the trust and manage them as the trustee. The “revocable” nature of the trust means that you can alter or dissolve the trust at any time, giving you complete control over your assets while you are alive. Upon your passing, the trust becomes irrevocable, and the assets are distributed to the beneficiaries according to your wishes, bypassing the probate process.

Benefits of a Revocable Living Trust

The primary benefits of establishing a revocable living trust include avoiding probate, maintaining privacy, reducing estate taxes, and providing for seamless management of your assets should you become incapacitated. Probate can be time-consuming and costly, but a trust allows for the direct transfer of assets to beneficiaries. Additionally, unlike a will, a trust is not a public document, which keeps your estate matters private. At W.B. Moore Law, our expertise in creating tailored revocable living trusts ensures that your estate planning goals are met with the utmost precision and care.

Choosing Your Trustee

When establishing a revocable living trust, one of the most crucial decisions is choosing a trustworthy and competent trustee. While many opt to serve as their own trustee during their lifetime, naming a successor trustee is essential for managing the trust in the event of your incapacity or death. The trustee’s role is pivotal in managing the trust’s assets, paying debts, and distributing assets to beneficiaries according to the trust’s terms. Our team at W.B. Moore Law can help you navigate the complexities of selecting a suitable trustee and understanding their responsibilities.

Funding Your Trust

For a revocable living trust to be effective, it must be properly funded. This means transferring the ownership of your assets—such as real estate, bank accounts, and investments—into the trust. Failure to adequately fund the trust can result in assets passing through probate, undermining one of the trust’s key advantages. The estate planning lawyers at W.B. Moore Law in Fort Collins, CO, provide comprehensive guidance on funding your trust to ensure it fully serves its intended purpose.

What is the first thing I will need to do

When considering the establishment of an estate plan, the first step is often the most crucial and can set the tone for the entire planning process. At W.B. Moore Law, we specialize in guiding individuals through the intricate journey of estate planning. As experienced estate planning lawyers in Fort Collins, CO, we understand the complexities involved and the importance of getting started on the right foot. The initial step in any estate planning endeavor is to conduct a thorough inventory of your assets and understand your goals for the future.

Inventory Your Assets

The first thing you will need to do is take a comprehensive inventory of your assets. This includes tangible assets such as real estate, vehicles, jewelry, and other personal property, as well as intangible assets like bank accounts, stocks, retirement accounts, and life insurance policies. Understanding what you own is critical in determining how to effectively distribute your assets and ensure your loved ones are cared for according to your wishes. At W.B. Moore Law, we assist our clients in Fort Collins, CO, in meticulously cataloging their assets, a fundamental step that forms the foundation of a robust estate plan.

Define Your Estate Planning Goals

After cataloging your assets, the next step is to clarify your estate planning goals. This may include providing for your family’s financial security, ensuring the care of minor children or dependents, minimizing taxes and legal fees, or contributing to charitable causes. Each individual’s goals are unique, and defining these objectives early in the process is crucial. Our team at W.B. Moore Law works closely with our clients to identify and prioritize their estate planning goals, ensuring that the resulting plan is tailored to meet their specific needs and aspirations.

Developing a Comprehensive Estate Plan

Developing a comprehensive estate plan involves more than just drafting documents. It requires a strategic approach that considers your financial situation, family dynamics, and legal implications. Our estate planning lawyers at W.B. Moore Law are dedicated to creating customized estate plans that provide clarity, security, and peace of mind for our clients and their families. We guide you through each decision, explaining the benefits and potential drawbacks, to ensure that your estate plan reflects your wishes accurately and effectively.

What if I forget to put something in my trust

In the intricate process of estate planning, overlooking an asset when funding your trust is a possibility that can have implications for your estate’s administration and your beneficiaries. At W.B. Moore Law, as seasoned estate planning lawyers in Fort Collins, CO, we understand the concerns that may arise if you realize an asset has been left out of your trust. Here, we’ll explore the steps and strategies to address this situation, ensuring your estate plan remains effective and aligned with your intentions.

Understanding the Impact

- Probate Exposure: Assets not included in your trust may be subject to probate, potentially delaying distribution and increasing costs.

- Estate Plan Discrepancies: An omission can lead to discrepancies between your trust and overall estate plan, possibly conflicting with your intended asset distribution.

Immediate Steps to Take

If you discover that an asset has been omitted from your trust, taking prompt action can mitigate any negative effects. Here’s what we recommend:

- Review Your Estate Plan: Regularly review your estate plan and trust documentation to ensure all assets are correctly included.

- Amend Your Trust: Consult with W.B. Moore Law to discuss amending your trust or creating a new trust document that includes the omitted asset.

- Pour-Over Will: Ensure you have a pour-over will in place, which acts as a safety net by directing any assets not included in your trust at the time of your death to be transferred into the trust.

Preventative Measures

- Comprehensive Asset Inventory: Maintain an up-to-date inventory of all assets and review it periodically with your estate planning lawyer at W.B. Moore Law.

- Professional Guidance: Regular consultations with your estate planning lawyer in Fort Collins, CO, can help identify any changes in your asset portfolio and ensure your trust is fully funded.

Utilizing a Pour-Over Will

A pour-over will is a critical component of a comprehensive estate plan, serving as a backup to capture any assets accidentally left out of your trust. It specifies that any assets outside the trust at the time of your death should be transferred into the trust, ensuring they are distributed according to your trust’s terms. This tool provides an additional layer of security, safeguarding your intentions and minimizing the risk of probate for these assets.

How Arbitration, Mediation, and Collaborative Divorce Different

Navigating the complexities of divorce can be a daunting process, with various dispute resolution methods available to couples seeking to separate. At W.B. Moore Law, while our primary focus is on estate planning, we understand the importance of providing clients with information that can help them make informed decisions in all areas of their lives, including when they face personal challenges such as divorce. Understanding the differences between arbitration, mediation, and collaborative divorce is crucial for anyone considering their options for dissolving a marriage. Each method offers distinct approaches and benefits, tailored to different situations and preferences.

Arbitration

Arbitration is a dispute resolution process where an arbitrator, a neutral third party, makes decisions regarding the divorce proceedings. The arbitrator’s decisions are usually binding.

- More formal than mediation but less so than court litigation.

- Can be faster and less expensive than traditional court proceedings.

- Offers privacy, as the proceedings are not part of the public record.

Best for couples who want a decisive resolution but prefer to avoid the publicity and formality of court.

Mediation

Mediation involves a neutral third-party mediator who helps the divorcing couple reach a mutually agreeable settlement. Unlike arbitration, the mediator does not make decisions for the couple.

- Encourages open communication and cooperation.

- Allows couples to maintain control over the outcome.

- Typically less costly and time-consuming than litigation.

Ideal for couples committed to working together to resolve their differences and who seek a personalized divorce agreement.

Collaborative Divorce

Collaborative divorce is a process where both parties, along with their attorneys and possibly other professionals (like financial advisors or therapists), work together to negotiate and resolve all aspects of the divorce without going to court.

Characteristics

- Requires a commitment from both parties to avoid litigation.

- Encourages mutual respect and open communication.

- Often involves a team approach, utilizing professionals from different fields.

Suitable for couples who wish to work together amicably and are willing to engage in honest, open discussions to reach a fair settlement.

Choosing the Right Method

Deciding on the best approach to divorce depends on several factors, including the relationship dynamics, the complexity of the marital estate, and the couple’s ability to communicate. At W.B. Moore Law, we advise our clients to consider their priorities and personal situations carefully when choosing a divorce method. It’s also crucial to seek professional guidance to understand the implications of each choice fully.

Fort Collins Estate Planning Statistics

According to national statistics, only 33 percent of Americans have an estate plan in place. Unfortunately, without a solid estate plan, many estates end up in probate, resulting in costs of more than $2 billion. Not only is probate expensive, but it can also take years for any issues to be resolved, leaving beneficiaries without the funds that the decedent had planned for them to have.

Don’t risk your estate being eaten up by legal fees and court battles. Call our office today to speak with an estate planning lawyer and find out how your family’s future can be protected when you are no longer here.

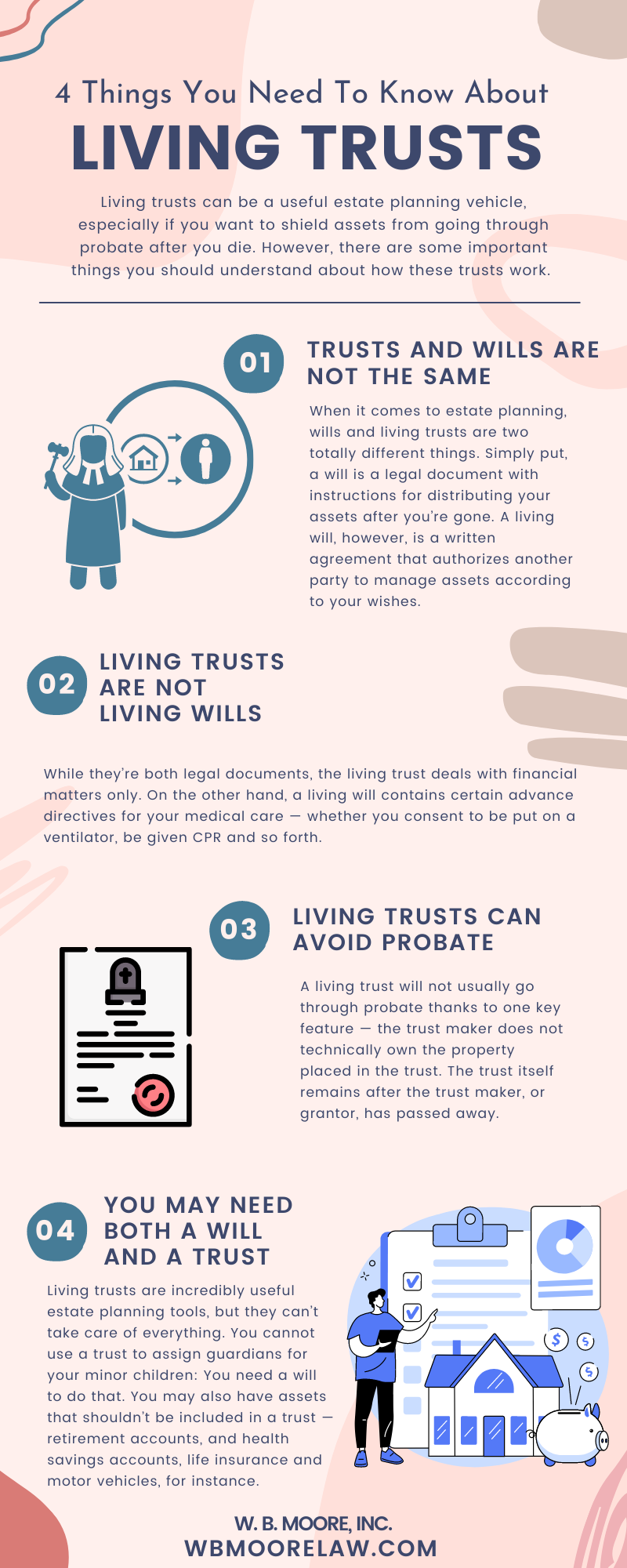

Why Trusts and Wills Are Not the Same

Understanding the distinctions between trusts and wills is fundamental in the field of estate planning. Although both are crucial tools used for planning one’s estate, they serve different purposes and offer unique benefits. At W.B. Moore Law, as dedicated estate planning lawyers in Fort Collins, CO, we aim to provide our clients with a comprehensive understanding of these differences, ensuring they can make informed decisions about how best to secure their legacy and protect their loved ones.

The Fundamental Differences

Wills

- A will is a legal document that outlines how a person’s assets should be distributed after their death.

- It becomes effective only upon the individual’s death.

- A will must go through probate, a court-supervised process of authenticating the will, paying debts, and distributing the estate.

- It is a public document once it enters the probate process, meaning the contents of the will and the details of the estate’s distribution are accessible to the public.

Trusts

- A trust is a legal arrangement where one party (the trustee) holds and manages assets for the benefit of another (the beneficiary).

- It can be effective during the grantor’s lifetime (in the case of a living trust) or upon their death.

- A properly funded trust can bypass the probate process, allowing for a potentially quicker, private, and sometimes more cost-effective distribution of assets.

- Trusts can offer more control over when and how assets are distributed to beneficiaries, such as stipulations for age, education, or specific milestones.

Avoiding Probate

One of the most significant advantages of a trust over a will is its ability to avoid probate. The probate process can be lengthy, costly, and public. Trusts, particularly revocable living trusts, allow assets to be transferred to beneficiaries without court intervention, preserving privacy and potentially reducing estate administration costs.

Control and Flexibility

Trusts provide a level of control and flexibility that wills cannot. For instance, a trust can specify conditions under which beneficiaries receive their inheritance (e.g., reaching a certain age or achieving a specific goal, like graduating from college). This detailed control helps ensure that the grantor’s wishes are executed precisely as intended, even long after their passing.

Privacy Concerns

For those concerned with privacy, a trust is often the preferred tool. Unlike wills, which become public record through the probate process, trusts remain private documents. This confidentiality can be crucial for individuals who wish to keep the details of their estate and beneficiaries out of the public eye.

Estate Planning Infographic

Estate Planning FAQs

What are the requirements for a valid will in Fort Collins, CO?

In Fort Collins, CO, for a will to be considered valid, it must meet specific legal requirements set forth by Colorado state law. The person creating the will (testator) must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator or by another person in the testator’s presence and at their direction. Additionally, the will must be witnessed by at least two individuals, both of whom are present to witness the signing by the testator or the testator’s acknowledgment of the signature or will. These witnesses must also sign the will in the presence of the testator and each other, making the document legally binding.

Can digital assets be included in my estate plan in Fort Collins, CO?

Yes, digital assets can and should be included in your estate plan in Fort Collins, CO. Digital assets include anything from online bank accounts and social media accounts to digital music, photo libraries, and cryptocurrency. Colorado law allows you to designate a digital executor or include specific instructions in your estate plan regarding how you wish these digital assets to be handled, accessed, or distributed upon your death. It’s important to provide detailed information and access instructions to ensure your digital executor can manage or distribute these assets according to your wishes.

How does the probate process work in Fort Collins, CO?

The probate process in Fort Collins, CO, involves the court-supervised administration of a deceased person’s estate. This process includes proving the validity of the will (if one exists), taking an inventory and appraisal of the deceased’s assets, paying off debts and taxes, and distributing the remaining assets to the rightful heirs or beneficiaries. The complexity and duration of the probate process can vary significantly, depending on whether the deceased had a well-structured estate plan and the size and complexity of the estate. In cases where there is no will, the estate is distributed according to Colorado’s intestacy laws.

Are there any estate taxes in Fort Collins, CO?

As of the latest information available up to April 2023, Colorado does not impose a state-level estate tax. However, estates may still be subject to federal estate taxes if they exceed the federal estate tax exemption amount, which is subject to change from year to year. It’s essential for individuals in Fort Collins, CO, to consider the impact of federal estate taxes when planning their estate and to explore strategies that may help minimize the estate’s tax burden for their heirs.

How can I ensure my healthcare wishes are respected if I become incapacitated in Fort Collins, CO?

To ensure your healthcare wishes are respected if you become incapacitated in Fort Collins, CO, you should consider creating advance healthcare directives as part of your estate plan. This includes a Medical Durable Power of Attorney, which allows you to appoint someone to make healthcare decisions on your behalf, and a Living Will, which outlines your preferences regarding end-of-life care and life-sustaining treatment. These documents provide clear instructions to healthcare providers and your appointed decision-maker, ensuring your healthcare wishes are followed even when you cannot communicate them yourself.

How W.B. Moore Law Can Help

Although W.B. Moore Law focuses on estate planning, we recognize the importance of providing our clients with resources and referrals for other legal matters, including divorce. We can help by:

- Providing Information: Offering detailed explanations of each divorce process and how they differ.

- Professional Referrals: Referring clients to experienced family law professionals who specialize in arbitration, mediation, or collaborative divorce.

At W.B. Moore Law, we are committed to providing detailed and personalized estate planning services. Our approach includes:

- Estate Plan Reviews: Offering periodic reviews of your estate plan to adapt to changes in your asset portfolio or personal circumstances.

- Customized Solutions: Tailoring strategies, such as drafting specific trust amendments or creating new trust documents, to include omitted assets.

- Educational Guidance: Educating our clients on the importance of comprehensive asset documentation and the role of a pour-over will.

Realizing you have omitted an asset from your trust can be concerning, but with the right steps and professional advice, it’s a situation that can be efficiently remedied. We invite you to contact us at W.B. Moore Law, where our experienced estate planning lawyers in Fort Collins, CO, are ready to assist you in updating your trust and ensuring your estate plan is comprehensive and reflective of your wishes. Let us help you secure your legacy and provide peace of mind for you and your loved ones.

If you’re facing the prospect of divorce and are uncertain about which path to take, we encourage you to reach out to us at W.B. Moore Law. Our team, while specialized in estate planning in Fort Collins, CO, is committed to supporting our clients through all life’s transitions. We can provide you with the information you need to make informed decisions and refer you to trusted professionals who can guide you through your chosen divorce process. Let us help you navigate this challenging time with dignity and respect.

Schedule Your Consultation Today

Navigating the complexities of estate planning laws in Fort Collins, CO, requires a nuanced understanding of both state and federal regulations to ensure your estate plan is robust, legally binding, and reflective of your wishes. At W.B. Moore Law, we are dedicated to guiding our clients through this intricate process, offering personalized advice and crafting estate plans that address every aspect of their legacy, from asset distribution and healthcare directives to digital asset management and tax planning. Our commitment to excellence and our deep knowledge of estate planning laws ensure that our clients in Fort Collins, CO, can achieve peace of mind, knowing their estate is well-prepared for the future, and their loved ones are protected.

W.B. Moore Fort Collins Estate Planning Lawyer

4025 Automation Way Building C, Suite 1 Fort Collins, CO 80525

Fort Collins Estate Planning Lawyer Google Review

“Bill Moore, is one of the most incredible people I have ever met. Sometimes working with an attorney can feel overwhelming and over your head. But that is not the experience I had with Bill. He explained everything clearly in ways that I could understand and laid out the process of what I needed to do in a logical and easy to follow steps. He truly cares about his clients and their goals. I highly recommend him for all your estate planning and business law needs!” – Ambar R.

Client Review

“I was glad I found Bill as my business attorney. He has more than 30 years of experience in business laws. Most importantly, he is dedicated and honest in his service. You cannot find many business attorneys like Bill. By the way, he is a big guy with a big heart.”

John Nguyen Trinh