Fort Collins Probate Lawyer

The probate lawyer in Fort Collins, CO from W.B. Moore Law is well-versed in all things estate plan related, and that includes probate. Probate is a legal proceeding that entails numerous steps. The intention of probate is to build an accounting of a deceased person’s assets. Depending on the assets, outside factors, and size of the estate, probate may be quick to complete or a prolonged and tedious process.

Table Of Contents

- Pros And Cons Of Probate

- Understanding A Special Needs Trust

- Probate Documents

- Colorado Probate Laws

- Fort Collins Probate Infographic

- FAQs About Probate Laws

- Probate Infographic

Probate ensures that a decedent’s debts are paid to creditors and other parties. After the initial steps of probate are taken, an executor or personal representative is appointed and assets are distributed to named beneficiaries or rightful heirs.

Pros and Cons of Probate

Probate is the method of transferring property of a person who has passed away to the new rightful owners. Someone who dies without an estate plan may risk having their assets go through the process of probate. As your probate lawyer in Fort Collins, CO can explain in more detail, if you have a revocable living trust and put assets into them, they won’t go through probate. But if you have a will, then your assets will be put through probate.

Probate is a public process that can have a significant impact on how an estate is handled. It can be the difference between a prolonged legal process and smoother transition for those you care about the most. The court steps in to oversee the handling of the estate so that it gets properly allocated after someone’s death. All assets will go through probate, whether they were included or not in your will, and having a will in itself won’t avoid probate. Typically, from start to finish, probate can take up to a year to complete.

If you have found yourself needing to participate in the probate process of someone you lost, you can anticipate needing a lawyer’s assistance, as it can get confusing and overwhelming quickly. Your Fort Collins probate lawyer can arrange for the estate to be opened to probate, where a representative will oversee the estate, debts and fees get paid from the estate, and then remaining assets will be distributed to rightful heirs. The court will handle the estate based on state intestacy laws.

With all this being said, why do people want to prevent probate if that’s possible? As your lawyer may discuss with you, probate can be an expensive process and takes time, meaning that beneficiaries won’t receive their inheritance for months to come, when those funds could have been used to financially sustain themselves during a period of grief. This is especially true for loved ones who were dependent on the deceased and are left without the support they had before.

In some cases, a person may want their estate to be part of the public record, which would happen under probate. This means anyone can access the details about someone’s estate. Probate is intended to protect individuals and creditors. Without having legally-binding estate plan documents, the court may be given the role to manage the allocation of assets so that outstanding debts are paid and then other assets are distributed to those who are to receive them by law.

Not everyone appeals to the idea of the court having a say in how their estate is handled after their death. Knowing this may be enough motivation to get someone to finally write an estate plan, since they want to protect the legacy they have been building over a lifetime. It’s only understandable that someone would want an easy transfer of their assets to those they care about the most. If you need help writing your first draft, or editing an outdated plan, our Fort Collins lawyer probate team can help ensure that your after life wishes are planned for accordingly.

If an estate is small, is probate still necessary

Even if an estate doesn’t have many assets, probate may still be necessary. In some states, there is something called a “simplified procedure”, which is used for estates that have a lower financial value. However, the definition of what is considered small will vary by the court and jurisdiction. If there is real estate or debts against the estate, no matter what size it is, probate may be required. Since the exact answer can vary, this is a question to ask your probate lawyer in Fort Collins, CO families trust from W.B. Moore Law based on your circumstances. Keep in mind that an estate, regardless of how vast or minimal it is, is worth protecting. Everyone’s legacy deserves to be organized in such a way that their last wishes are followed.

What factors could potentially invalidate a will

There are many factors that could cause a will to become invalidated. Someone may attempt to falsify a will by misrepresenting their authority or signing with another’s name. These factors would constitute fraud, and the will would be deemed invalid by the court. Another reason would be someone who doesn’t have the mental capacity to write a will, then the court may consider it void. As your Fort Collins probate lawyer can explain, if a will was written while the person was under undue influence or duress, this can be grounds for invalidation as well.

Who can officially declare a will as invalid

The court will review the will and decide whether it should be followed, or not. If the court deems it is not valid, then they will choose how the person’s assets are to be distributed, and the will no longer has bearing on who is to receive which assets. The only entity that can officially declare a will as invalid is the court under probate. If you are concerned about a will and its validity, then we suggest contacting our law firm for further guidance. This is a delicate matter that must be taken seriously, so we hope that if there are issues with a will and whether it is legally-binding or not, that you contact us.

When do I need a lawyer to help with probate

There is no legal requirement that you have a lawyer for probate, however, those who don’t have legal support often find the entire process to be confusing and overwhelming. The death of a cherished person can bring out the worst in people, and some families may become at odds with each other despite the grief they are all experiencing. Our team has been the support system that families need when their relative’s legacy is forced to go through probate. It can be an emotionally turbulent time, and most people don’t have in-depth knowledge into probate or estate law. Without a Fort Collins lawyer probate team, families are vulnerable to carrying more weight they need to, especially at such a sensitive time.

Reasons to Develop a Special Needs Trust

When planning for the future, a Fort Collins, CO special needs trust lawyer can explain that a trust may be advantageous. A trust can be a way of instructing how assets are distributed to heirs, how children will be cared for, and minimizing the number of assets that are passed through probate. Developing a trust is complicated, and several types of trusts are available depending on the specific situation. A lawyer from W.B. Moore Law can play a critical role in reviewing their client’s interests and determining the proper type of trust. A special needs trust is just one type of option available, and there are several reasons to consider developing one for beneficiaries unable to make decisions on their own.

Understanding a Special Needs Trust

A trust is an arrangement and is often a component of an estate plan. These fiduciary arrangements are often used to assist beneficiaries in gaining access to their inheritance sooner because these assets will not have to pass through probate. Trusts can reduce taxes, protect assets from creditors, allow for privacy, and allow the grantor to provide instructions that clearly outline how assets are distributed. In addition, a trust can also include instructions for how dependents should be cared for. A special needs trust is a specific arrangement allowing the grantor to ensure loved ones who are disabled or chronically ill.

The following are several reasons to consider a special needs trust:

Reason #1: To Protect Access To Government Benefits

As a trusted Fort Collins special needs trust lawyer is aware that chances are, your disabled loved one may be dependent upon benefit programs like Social Security disability benefits, Medicaid, or Supplemental Security Income. These government dependents may be imperative for caring for a loved one; however, they risk losing out on these much-needed benefits if they stand to inherit assets. However, by developing a special needs trust with a lawyer, it’s possible to create a trust that allows the beneficiary to access their benefits while ensuring that trust proceeds are distributed as instructed.

Reason #2: To Keep the Process Private

Probate is a public process, and when a person passes away, anything that goes through probate is available for the public eye. Having a disabled person inherit assets can leave them vulnerable to others looking to take advantage. A special needs trust can ensure that the assets inherited by your loved one are kept private.

Reason #3: To Include Careful Instruction

To develop a special needs trust, it will be essential to have a clear understanding of the needs of the beneficiary. The grantor should have an idea of the needs of their loved ones for the future as they plan how they will fund the trust. These trusts can protect from financial abuse and allows the grantor to provide clear instructions for how finances will be disbursed.

For people with children or family members whom they care for, there is nothing more concerning than the idea of no longer being able to take care of the people they love. Because of this, engaging in the estate planning and trust development process is one of the most critical steps a person can take. To learn more about how you can preserve inheritance and ensure your loved one is cared for, contact our Fort Collins special needs trust lawyer from W.B. Moore Law today!

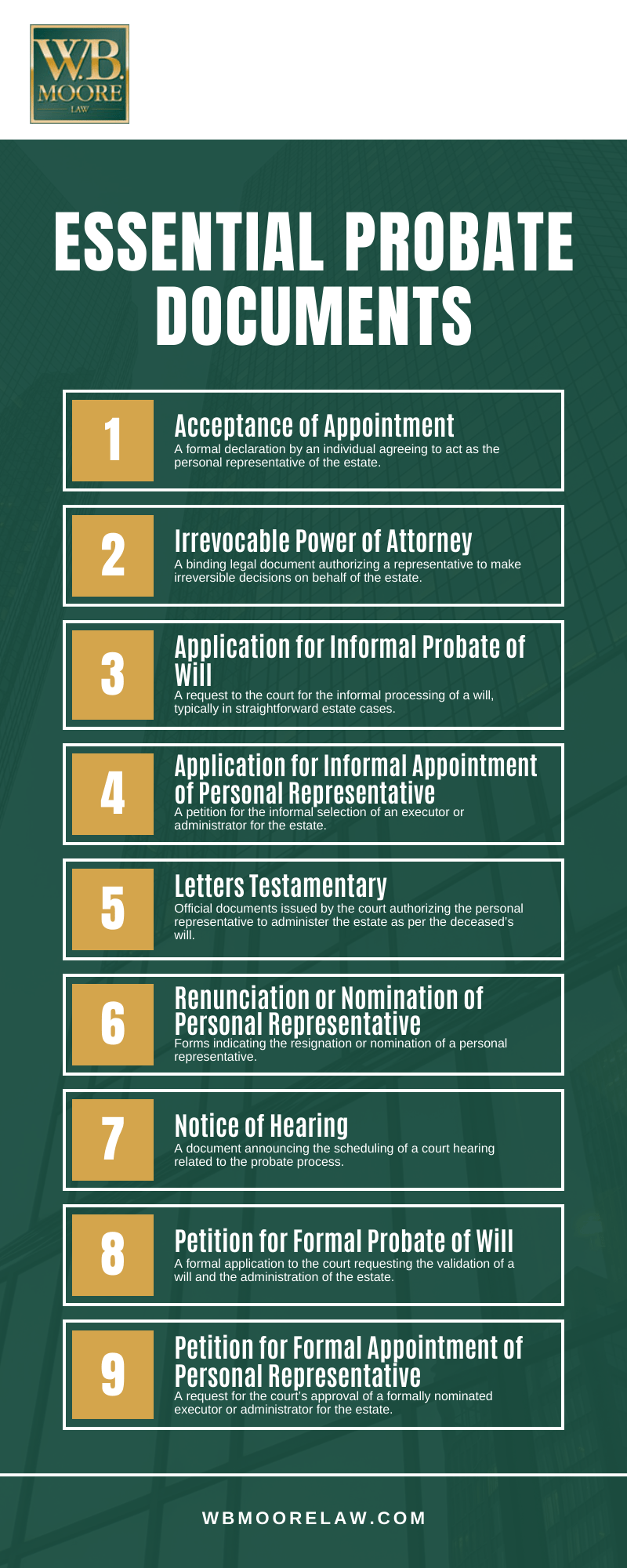

Probate Documents

In the intricate process of probating a will within Colorado’s legal framework, it’s crucial to distinguish whether the decedent’s estate falls under the category of a formal or informal estate. This distinction is pivotal as it influences the procedural approach and the documentation required. Often, this assessment can be complex, leading many individuals to seek professional legal guidance.

If you find yourself uncertain about the nature of the estate in question and the preparatory steps needed for probate proceedings, it is highly recommended to consult with a seasoned probate attorney. Our team, based in Fort Collins, Colorado, specializes in probate law and is equipped to assist you through each phase of the process.

Our Fort Collins, CO probate lawyers are adept at guiding clients through the maze of probate documentation, ensuring compliance with state laws and regulations. They can help you meticulously prepare and submit essential probate documents, which include, but are not limited to:

- Acceptance of Appointment: A formal declaration by an individual agreeing to act as the personal representative of the estate.

- Irrevocable Power of Attorney: A binding legal document authorizing a representative to make irreversible decisions on behalf of the estate.

- Application for Informal Probate of Will: A request to the court for the informal processing of a will, typically in straightforward estate cases.

- Application for Informal Appointment of Personal Representative: A petition for the informal selection of an executor or administrator for the estate.

- Letters Testamentary: Official documents issued by the court authorizing the personal representative to administer the estate as per the deceased’s will.

- Renunciation or Nomination of Personal Representative: Forms indicating the resignation or nomination of a personal representative.

- Notice of Hearing: A document announcing the scheduling of a court hearing related to the probate process.

- Petition for Formal Probate of Will: A formal application to the court requesting the validation of a will and the administration of the estate.

- Petition for Formal Appointment of Personal Representative: A request for the court’s approval of a formally nominated executor or administrator for the estate.

Recruiting Support

Handling probate on your own can prove confusing and overwhelming. You may wonder whether you can navigate it yourself, or if a lawyer is recommended. Albeit the choice is a personal one, you are likely to reach a point where you need legal clarification, questions answered, or other concerns addressed. A lawyer is going to be an influential person to help you, since they have a deep knowledge of law and how the court system works.

Colorado Probate Laws

Probate can be hard to navigate for the average person, but a Fort Collins, CO probate lawyer can provide helpful and meaningful assistance. Our experienced probate lawyers are here to guide you through the intricacies of Colorado’s probate laws. Having valuable insights into specific laws related to probate in Colorado, ensuring you have the knowledge you need to make informed decisions during this challenging time.

Probate In Colorado

Probate is a legal process that occurs after a person has passed away, and it is often a highly complex and inconvenient one. It involves the distribution of their assets and settling their debts. In Colorado, probate proceedings are governed by specific laws and regulations, primarily found in the Colorado Probate Code. One crucial aspect of Colorado probate law is that it distinguishes between formal and informal probate processes.

Formal Vs. Informal Probate

Under Colorado law, there are two main types of probate processes: formal and informal. The choice between the two depends on the circumstances of the estate. Formal probate is necessary when there are disputes, contests, or complexities in the estate administration. It requires court oversight and is more time-consuming. Informal probate, on the other hand, is a simpler and quicker process suitable for uncomplicated estates. An experienced Fort Collins probate lawyer can help you decide which one is best for your situation.

Intestate Succession

When a person passes away without a valid will or estate plan, Colorado probate law dictates how their assets will be distributed. This is called intestate succession. The state’s laws provide a specific order of priority for distributing assets, which may not align with the deceased’s wishes. To avoid intestacy and ensure your assets are distributed according to your preferences, it is crucial to consult a probate lawyer to create a valid will or trust.

Homestead Protection

Colorado probate law offers protection to surviving spouses and certain family members when it comes to the family home. The law allows for a surviving spouse or a minor child to claim the family home as a homestead, exempting it from being included in the probate estate. This specific protection ensures that family members of a deceased individual have a residence to live in following their death.

In Colorado, understanding the specific laws related to probate is essential when dealing with the complexities of estate administration. Whether you are faced with formal or informal probate, intestate succession, or homestead protection issues, our experienced probate lawyers are here to provide you with the guidance and support you need. Don’t navigate this challenging process alone. If you want to make sure that your interests and values are protected, do not wait to consult a lawyer for more information.

Explore Your Legal Options

If you need assistance with probate matters in Colorado, don’t hesitate to reach out to our experienced probate lawyers. We are here to help you navigate the intricacies of Colorado probate law and provide you with the support you need during this challenging time. If you need help with the probate process or have questions about how to navigate it, contact a skilled Fort Collins probate lawyer as soon as possible.

Fort Collins Probate Infographic

Fort Collins Probate Law Statistics

According to national statistics, more than 60 percent of American adults do not have a will or estate plan. This is why about 70 percent of estate inheritances result in disputes or litigation among heirs.

Call our office today to speak with a Fort Collins probate lawyer to ensure you have an iron-clad, non-contestable estate plan in place so your last wishes will be kept.

FAQs About Probate Laws in Fort Collins, CO

What is probate?

As a probate lawyer Fort Collins, CO residents can explain, probate is the court process in which a decedent’s will is proven valid. During this process, your assets have to be located and assessed for total value. Then, debts are paid and the remaining assets are distributed to heirs.

What must go through probate?

Regardless of whether or not you have a will, certain assets will have to go through the probate process. These assets include sole ownership property, non-titled property and partner-owned investment property.

What doesn’t have to go through probate?

Through proper planning, some of your assets may not have to go through probate. For example, the assets you placed in a living trust will not have to go through probate because the trust owns them. They will go directly to your beneficiaries after you die. If you have jointly owned property with someone, that property also won’t go through probate. Additionally, if you name a beneficiary on an asset, like an insurance policy, it won’t have to go through the probate process.

How long does probate take?

This is one of the first questions on people’s minds. Probate has a long reputation for being a long, drawn out process. However, this is not the case with many estates. If your estate is fairly small and no one tries to challenge it, probate can be completed in a year or less. However, if there are more complexities, probate can take longer to finish.

How does probate start?

The executor of that state will file a petition with the probate court. A Fort Collins probate lawyer must represent the estate. Notices will be sent to the heirs to let them know probate has begun. A notice will also be published in the local newspaper to notify creditors about probate.

How can a lawyer assist with the probate process?

Probate proceedings can involve some complexities, so it is beneficial to have a skilled lawyer on your side. A probate lawyer can explain the process to your heirs and appear in court on their behalf. He or she can also handle any will contests. Working with an experienced lawyer can take a lot of pressure off your back.

Can a will help avoid probate?

No, this is a common misconception people have. The truth is that a will can only allow you to control certain aspects of the probate process, such as selecting an executor and deciding who will receive your property. If you don’t have a will in place, probate will be governed by the Probate Act.

How much does probate cost?

The cost of probate may include executor’s fees, appraisal costs and court costs. The total cost may depend on multiple factors, such as the value of the estate, the complexity of the estate and whether the will is contested.

W.B. Moore Law, Fort Collins Probate Lawyer

2809 E Harmony Rd #100, Fort Collins, CO 80528

Read more of our Google reviews and let us know how we can help you with your probate case.

Contact W.B. Moore Law Today

The team at W.B. Moore Law is seasoned in handling probate and can offer insight that you may not have known otherwise. We can be a reliable source of information, representation, and protection. We know how to use the law for the betterment of our clients. So if you are in need of help regarding an estate issue, we strongly suggest contacting a probate lawyer in Fort Collins, Colorado at W.B. Moore Law today for a consultation.

Client Review

“I was glad I found Bill as my business attorney. He has more than 30 years of experience in business laws. Most importantly, he is dedicated and honest in his service. You cannot find many business attorneys like Bill. By the way, he is a big guy with a big heart.”

John Nguyen Trinh